As we head into 2024, the costs associated with trucking insurance are undergoing some significant repositioning. Factors influencing these transformations are abundant, from global economic recessions to operational constraints within the sector. Knowing which aspects are undergoing change and why, deserve the attention of trucking firms and owner-operators in order to make proper assessments of their insurance needs in the current business environment.

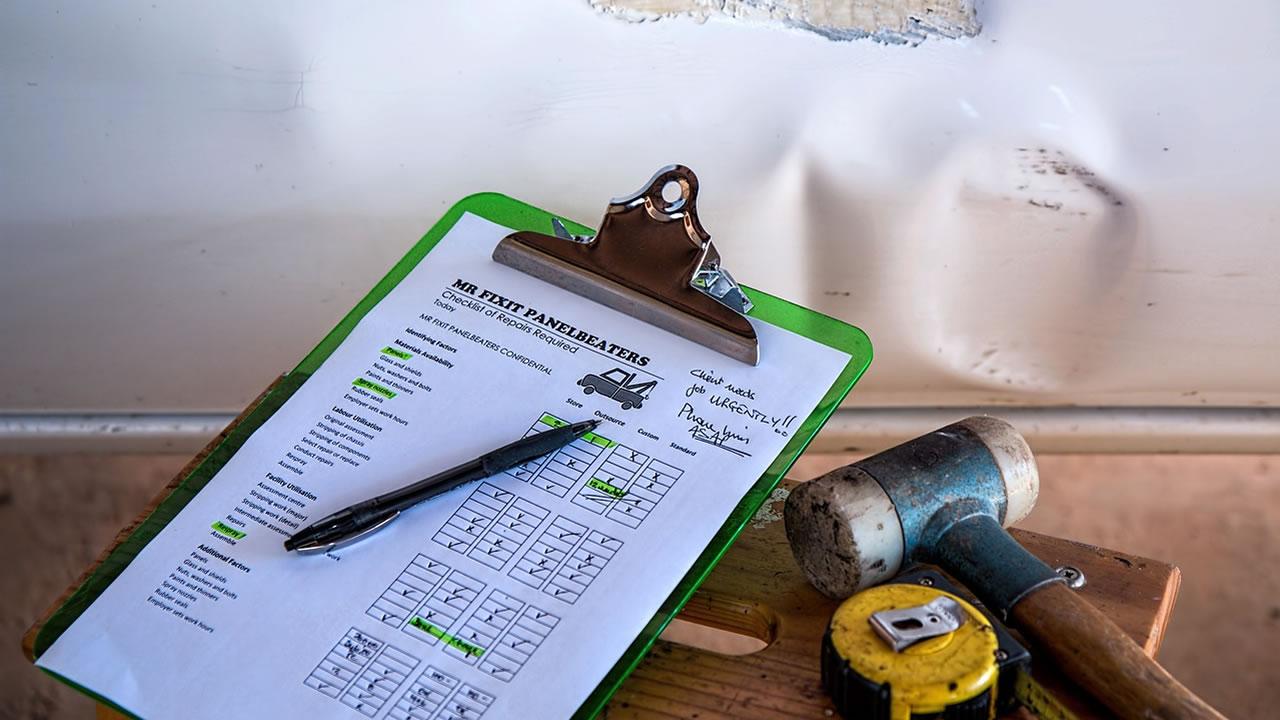

Increasing Repair Costs Worsening Inflation:

Unofficially, one of the primary factors driving up premiums for truck insurance in 2024 is the increased inflation as well as rising supply chain shortages leading to increasing repair costs. Thus, truck components as well as labor for repairs have increased and so the insurer must point out that the premiums must be increased to offset the expenses. Moreover, as both minutes and dollars increase to repair or replace loss trucks, the financial exposure for the insurer also does go higher which results in increased rates across all businesses that are dependent on the commercial trucks.

The Effect Of Fuel Costs On The Insurance Premium Rates.

Most truck insurance costs have a dependence on the fuel and operational costs. As the fuel costs remain on the higher side throughout the year 2024, trucking firms will have to bear or incur higher operating expenses and the likelihood of accidents or vehicle malfunctions arising increases too. Insurers will seek to do an upward adjustment of the premiums to factor this possibility for additional risk, if the target business is about long haulage as a case in point.

In order to protect their vehicles and their cargo, trucking companies may soon have to pay considerable amounts for coverage as fuel costs continue to rise. Andres R’s assessment was mainly based on US factors. He shrewdly added, “We need to get really serious about looking at some of the other markets outside of the U.S. and I think the 2021-2022 expansion efforts were necessary.” With fuel prices projected to keep climbing, rising coverage costs figure prominently in the US market over the next few years. For domestic factors, Sofiya M noted that due to international factors, alternative fuel supply contracts will always be needed. Therefore it would be prudent to consider many different approaches to fuel oil supply patterns and markets.

The Impact of Insurance Premiums on Risk and Liability

It is common knowledge that there are increasing accident and risk rates in worldwide operations of large commercial trucks. Read More: Severe Operational Disruptions Expected Around November 2024. Compared with data from the three Emirate states, the most common factors for truck breakdown were low temperatures and wind. This was backed by Eric’s findings on breakdown frequency, saying, “From a global perspective, understanding the factors affecting any breakdown can be highly variable.”

Currently, insurers state that companies using, or just implementing, modern safety practices are bad news for them. These practices include telematics, monitoring driver behaviour, and accident prevention systems, which would likely help lower the company’s premiums. Such excessive headache is caused by either doing your job poorly or having lack of preventative measures when performing it. Thankfully, with increasing emphasis on being data centred, I foresee many fleet companies being able to recoup some of these premium increases through factors like accident frequency and fleet upkeep.

Legal Actions In Relation To Insurance Premium Costs

Trucking firms will apply risk management strategies in 2024 that include making up ‘the difference’ when confronted with the possibility of dealing with drastic increases in their operating costs. Read More: New Environmental Protection Rules To Completely Change The Process of Making New Oil Rigs. For instance, companies obtain additional coverage or employ economically viable resources to avoid dealing with the need to pay for policy costs that appear to be unreasonable or out of line.

These policies allow internal costs to be transferred into external resources. Several clever innovative strategies exist that trucking companies can put to use while expanding operations in the intense level of competition and dealing with shock waves of extreme cost rises to allow them to maintain the working capital needed to operate through, manage adequate additional coverage while controlling their insurance costs.